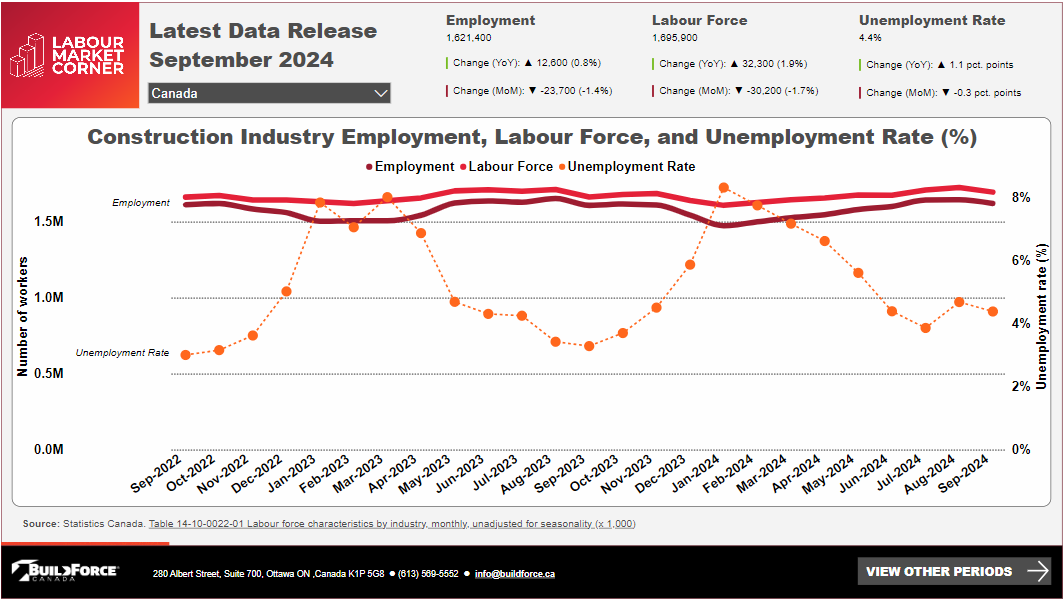

The construction labour force expanded from just over 1.66 million in September 2023 to just under 1.70 million in September 2024, after reaching a peak of just over 1.73 million in August 2024.

Despite the small decline from August to September, the labour force remained larger than it was a year earlier. This reflects an ongoing expansion in the supply of workers in the construction industry, driven by sustained demand for skilled labour across infrastructure, residential, and commercial projects.

Employment in the construction sector increased from just over 1.61 million in September 2023 to just over 1.64 million in August 2024, before dropping slightly to just over 1.62 million in September 2024. While this modest decline indicates a slight softening in the construction labour market as the season shifts, employment levels still surpassed those of the previous year. This suggests that the construction industry continues to create jobs, albeit at a pace that lags slightly behind labour force growth.

The unemployment rate in the construction industry increased by 1.1 percentage points, rising from just over 3.3% in September 2023 to just under 4.7% in August 2024, before improving slightly to just over 4.4% in September 2024. The rise in unemployment earlier in the year can be attributed to the faster growth of the construction labour force relative to job creation. However, the slight decrease in the unemployment rate in September suggests that, while the labour force has contracted somewhat, employment opportunities remain strong enough to absorb a portion of the available workers.

The greatest growth in employment over the past year occurred among the youngest demographic, those aged 15 to 24 years. Both the employment and labour force figures increased significantly within this group, with the labour force growing by 21.7% (an increase of 38,200 workers) and employment rising by 24.4% (an increase of 40,600 workers). This substantial increase highlights a surge in young workers participating in and contributing to the construction sector over the past year.

Conversely, the data shows a marked contraction in employment among core-aged workers, those aged 25 to 54 years. The labour force in this group declined by 0.3% (a decrease of 3,800 workers), while employment dropped by 2.3% (a loss of 25,600 workers). This decline suggests challenges in retaining or increasing employment levels among prime working-age individuals in the construction industry.

For workers aged 55 years and over, both the labour force and employment contracted slightly. The labour force declined by 0.6% (a decrease of 2,100 workers), while employment dropped by 0.7% (a decrease of 2,200 workers), indicating a modest reduction in participation and employment for older workers in the sector.

September’s relatively muted performance can be attributed to a second consecutive significant slowdown in Ontario. Employment in the province’s construction sector contracted by 37,800 workers, or just over 6%, compared to the year previous. An ongoing slowdown in the province’s residential sector may be responsible. For the 12-month period ending August 2024, residential building permit values are down 23%, while housing starts have contracted by 28%. A closer look at the province’s residential construction data finds a small increase in the number of single-detached housing starts over the past 12 months – likely created by the easing of interest rates in recent months – but a sharp decline in multi-unit properties and apartments in particular, which were down 41% over the last year.

At -1,100 workers (-1.9%) Manitoba was the only other province to report a year-over-year employment contraction. As in Ontario, building permit activity in Manitoba dropped significantly over the past 12 months, losing 49% in value to August 2024. Residential permit values were down by 51% in the province, while non-residential values contracted by 44%.

Among all other provinces, British Columbia recorded the largest year-over-year employment increase at 18,200 workers, or 8.1%. Also reporting large gains were Quebec (15,900; 4.8%), Nova Scotia (6,500; 17.2%), and Alberta (5,400; 2.2%).

Construction unemployment rates across the provinces varied from a high of 13.3% in Newfoundland and Labrador to a low of 1.7% in Manitoba. Most other provinces reported rates of between 3% and 5%. It is again worth indicating that current employment figures should be taken in proper context. Construction unemployment rates reached historically low levels in the summer of 2023, with the non-residential sector of the industry in particular operating at or near capacity in most regions of the country. These levels of activity were unlikely to be sustained over a long period.

Construction Key Indicators