Construction employment dropped in August, in part due to a strong contraction in Ontario.

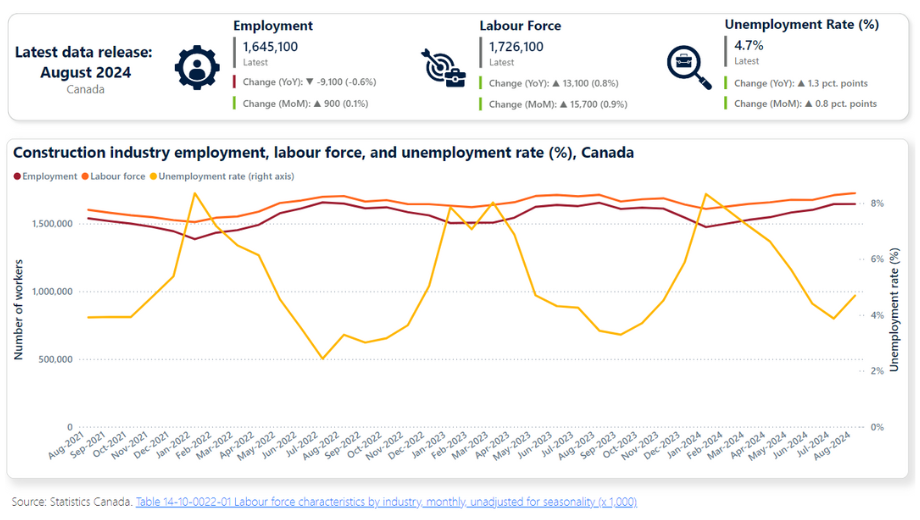

The latest Labour Force Survey (LFS) data from Statistics Canada finds that construction employment declined by 9,200 workers, or -0.6%, nationally, compared to levels reported in August 2023. Over the same period, the construction labour force grew by 13,100 workers, or, 0.8%. As a result, the industry’s unemployment rate rose from 3.4% to 4.7%.

While new-home construction has rebounded in many provinces across the country, markets continue to adjust lower in Ontario, Manitoba, and British Columbia. Housing starts, year-to-date, report lower figures for all three provinces with largest declines in the construction of low-rise housing units (i.e., single-detached, semi-detached, and row housing).

With a year-over-year contraction of 43,000 workers, or -6.9%, Ontario recorded by far the largest drop in employment among the provinces – primarily driven by declining construction of low-rise housing units. At -5,600 workers (-8.9%) and -3,600 workers (-1.4%), Manitoba and Alberta reported the next-largest contractions.

For context, it is worth noting that six of the ten provinces, including all four Atlantic provinces, reported year-over-year employment gains over the past 12 months. At 29,200 workers, or 13.3%, British Columbia reported by far the largest annual employment increase among the provinces. Quebec followed with a rise of 9,600 workers, or 2.9%. Gains among the Atlantic provinces ranged from a high of 2,900 workers (7.3%) in Nova Scotia to a low of 600 workers, or 2.8%, in Newfoundland and Labrador.

Employment trends across genders followed a similar pattern. Overall employment among males contracted by 9,300 workers, or -0.6%, nationally, as Ontario reported a drop of 33,200 workers, or -6.1%. Alberta and Manitoba also reported drops of -5.2% and -11.2%, respectively. British Columbia again reported the greatest increase among male employment at 27,200, or 14.1%. Increases in other provinces ranged from a high of 7,800 (2.7%) in Quebec to a low of 200 (0.5%) in Saskatchewan.

Worth noting is a significant increase in employment among young males (i.e., those aged 15 to 24 years). Nationally, this cohort grew by 13.3%, compared with a year ago. Gains among this group were significant in Quebec (41.9%), Alberta (33.2%), and British Columbia (17.6%). Employment among core-aged males, i.e., those aged 25 to 54 years, declined by 2.5% nationally, compared to August 2023. Losses were reported in seven provinces.

Employment among females was largely unchanged over the course of the past 12 months, growing by 300 workers, or 0.1%. Ontario again reported the greatest contraction, but this was more than offset by gains in seven provinces, led by Alberta. Employment gains among women were greatest in the youngest cohort (i.e., those aged 15 to 24 years) at 15.6% nationally, while employment among core-aged women (those aged 25 to 54 years) contracted 3%.

In August 2024, construction unemployment rates across the provinces varied from a high of 10.2% in Newfoundland and Labrador to a low of 3.9% in Quebec. All other provinces reported rates of between 4.0% and 5.9%.

Rising trends in national unemployment rates for construction is primarily a function of receding employment in Ontario – a large market that influences national figures. While construction unemployment rates in Ontario is now slightly above their 10-year average for the month of August, for most other provinces unemployment rates are well below their historical levels. This is especially the case for the Atlantic provinces, which face older age demographics and are grappling with higher retirements and fewer younger workers available to backfill vacant positions.

The employment contractions reported in the August LFS data should be viewed in context. The summer of 2023 saw construction unemployment rates reach historically low levels as the industry operated at or near capacity in the non-residential sector. Such activity was unlikely to be sustained over a long period.

Moreover, the change in employment over the past 12 months can likely be attributed to a softening of activity in the residential sector that has been driven by rising interest rates and increasing housing prices.

As the Bank of Canada lowered its key interest rate for the third time in 2024 in September, market pressures are beginning to soften, and housing starts are returning to growth.

Construction Key Indicators