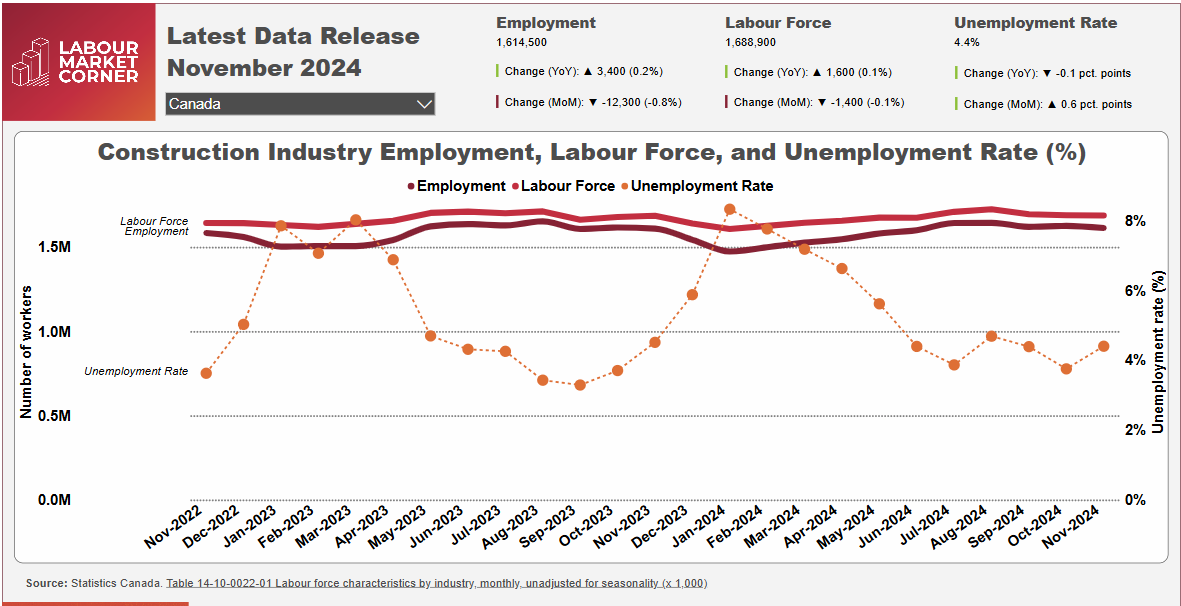

Key construction employment indicators reported only modest gains over the past 12 months, with employment rising by 3,400 workers, or 0.2% year over year, and the labour force adding just 1,600 workers, or 0.1% over the same period. These factors combined to reduce the industry’s national unemployment rate from 4.5% a year ago to 4.4%.

The November data from Statistics Canada’s Labour Force Survey (LFS) suggest that construction activity across the country could be slowing ahead of the winter months. Compared with October 2024, November’s industry unemployment rate is up 0.6 percentage points while employment is down 0.8%.

Despite the muted overall performance, a closer look at the year-over-year data for November 2024 reveals two positive trends. The first is that employment and labour force gains were driven by significant increases among the youngest cohort of workers, i.e., those aged 15 to 24 years. Employment within this group rose by 15.2% over the past 12 months, while the labour force increased by 10.4%. As a result, the cohort’s unemployment rate was cut almost in half – from 9.4% a year ago to 5.5%. Notably, this cohort was the only age group to report gains in both employment and labour force figures.

Also positive was the increase in employment among females in the industry. Again, considering the past 12 months, overall employment among females was up 7.2%, while the labour force rose by 5.7%, and the unemployment rate dropped from 4.0% to 2.7%. Absolute gains were greatest among the core-aged cohort of 25 to 54 years, where employment rose by 11,200 workers, and the labour force increased by 9,500.

In contrast, the LFS data for males finds employment down by 0.8% year over year, the labour force down 0.7%, and the unemployment rate up by 0.1 percentage point. The data showed large differences in employment among the youngest cohort, where employment rose by 16.5% (+24,400 workers), and the core-aged group, where it dropped by 3% (-29,400 workers).

Ontario, British Columbia are biggest year-over-year changers in November

Employment data trends once again varied across the provinces.

British Columbia and Quebec led the way over the past 12 months, with employment increases of 16,900 (7.4%) and 14,100 (4.3%) workers, respectively. Four other provinces reported more modest absolute year-over-year gains in their respective employment numbers.

By far the greatest contraction over the past 12 months was reported in Ontario, where employment dropped by 5.7%, or -34,200 workers. With 11 months worth of labour force trends now reported by Statistics Canada, construction employment in Ontario is down 4.6% on a year-to-date basis. Interest rates and changes to federal immigration policy continue to dampen residential construction activity, particularly in and around the Greater Toronto Area. For context, the number of new housing unit starts from January through October is sitting at a 19% contraction compared to the same period last year, with declines reported across all structure types. Within that data, year-to-date starts for apartment units are down 21%, a fact that could suggest a large amount of unsold inventory on the market and tighter lending conditions for developers.

Also reporting employment contractions were Alberta at -3,800 workers, or -1.5%, Manitoba (-1,700; -3.1%), and Newfoundland and Labrador (-1,200; -5.6%).

Finally, November unemployment rates across most provinces varied from a high of 8.1% in New Brunswick to a low of 2.7% in Quebec.

Construction Key Indicators