In this four-part series, BuildForce Canada presents and examines some of the key data points emerging from the past 12 months in the construction sector. In this post, the first of the series, we look at construction’s overall economic output for 2023. Later posts will look at outcomes in the residential and non-residential sectors, and on the labour force.

If Canada’s construction industry in 2023 were to be characterized by one word, it would be “turbulent”. While rapidly rising interest rates significantly curbed growth in new-home construction, a glut of major transportation and public infrastructure projects sustained the demand for construction workers.

Throughout 2023, output in the residential and non-residential construction sectors diverged. Growth in non-residential construction only partially offset sharp declines in the residential sector. As a result, building permits and investment were brought below elevated levels see in 2022 and led to a decline in construction’s gross domestic product (GDP) – although drops were mostly concentrated in the residential sector.

Despite reduced demands in the residential sector, labour market tightness prevailed in most markets across the country. Due to a growing labour force, the unemployment rate edged higher, but remains well below pre-pandemic levels. And although job vacancy rates in construction have subsided from the peak levels reached in 2022, they remain above the all-industries vacancy rate and above pre-pandemic levels.

This blog looks at the key trends that unfolded in the Canadian construction sector in 2023, based on key indicators tracked and analyzed by BuildForce Canada.

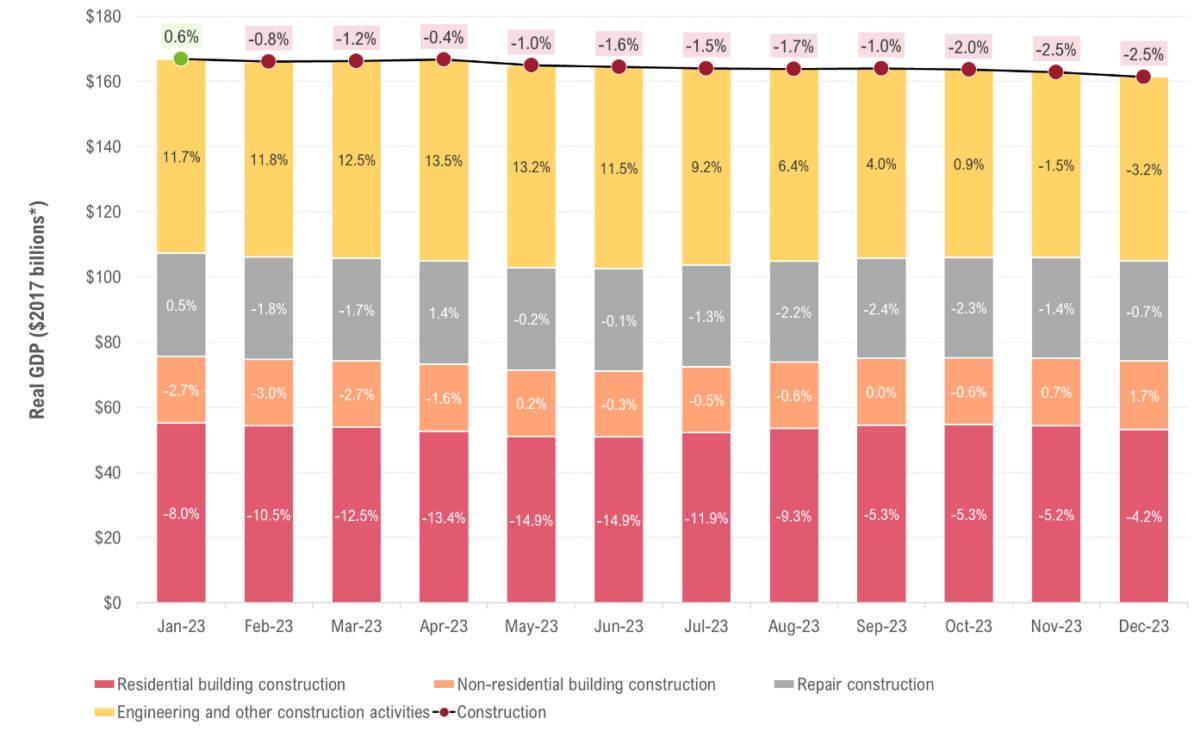

Construction GDP contracts in 11 of the 12 months of 2023

In 2023, total construction real GDP (adjusted for inflation) averaged $165 billion per month. That figure represented a 1.3% decline from the $167 billion achieved in 2022.

The overall decline in construction GDP for 2023 was mostly concentrated in the residential sector as rapidly rising interest rates slowed demand for new residential construction. Compared to 2022, residential construction GDP fell 10% in 2023, with some months reporting declines of nearly 15% versus the same month in 2022.

Real GDP for the construction of non-residential buildings also reported a series of contractions throughout the year, although these declines were more modest than those in the residential sector. Building permit data and BuildForce Canada’s major projects inventory suggest that these declines were mostly driven by slowing commercial and industrial activity, with the former continuing to experience high post-pandemic vacancy rates. Institutional building activity continued to track an upward trend throughout the year, driven by large volumes of education and healthcare sector projects in nearly every province.

Real GDP related to repair (maintenance) construction also reported periods of decline in 2023 compared to the same period a year prior. These declines were likely associated with higher inflation and rising interest rates.

The GDP related to engineering construction reported strong growth in the first seven months of the year, driven by large capital projects across the country, including a series of multi-billion-dollar public transit projects in Ontario. GDP growth for this segment of construction slowed in October and posted negative rates in the last two months of the year – most likely due to major project completions.

Construction industry real GDP, Canada, monthly

Construction real GDP in constant (2017) dollars and year-over-year percentage changes (%)

* $2017 billions indicates that the investment values are in year 2017 dollars (base year), that is, adjusted for inflation. This is used to calculate the real physical year-to-year change of the value of construction, factoring out growth (increase in value) due to increases in prices.

In terms of the composition of construction GDP across the four segments, there was a slight increase engineering construction and a slight decline in residential construction. In 2023, residential building construction GDP amounted to $53 billion and accounted for an average of 32% of the country’s total construction GDP (down from for 36% of construction GDP in 2022).

GDP related to engineering construction rose to $60 billion and accounted for 36% of GDP – a rise from the 33% realized in 2022. GDP associated with the construction of non-residential buildings came in at $20 billion, while GDP related to repair (maintenance) construction amounted to $31 billion.

For more information about these trends, click through to our 2024 to 2033 Construction and Maintenance Looking Forward highlight reports. And watch for part two of this blog series, scheduled for release in June, where we look at how housing demands have been shaped by rising interest rates.

Construction Key Indicators