In this four-part series, BuildForce Canada presents and examines some of the key data points emerging from the past 12 months in the construction sector. In this post, the second of the series, we look at the trends that impacted Canada’s residential sector. Part 1 of this series looked at construction’s overall economic output for 2023.

From an economic standpoint, the COVID-19 pandemic was one of the most disruptive events seen in generations. Even now, more than four years removed from its onset, the ripple effects of the pandemic continue to be felt. Inflation in particular has soared, with costs for essentials, such as food and housing, across Canada rising significantly since 2022.

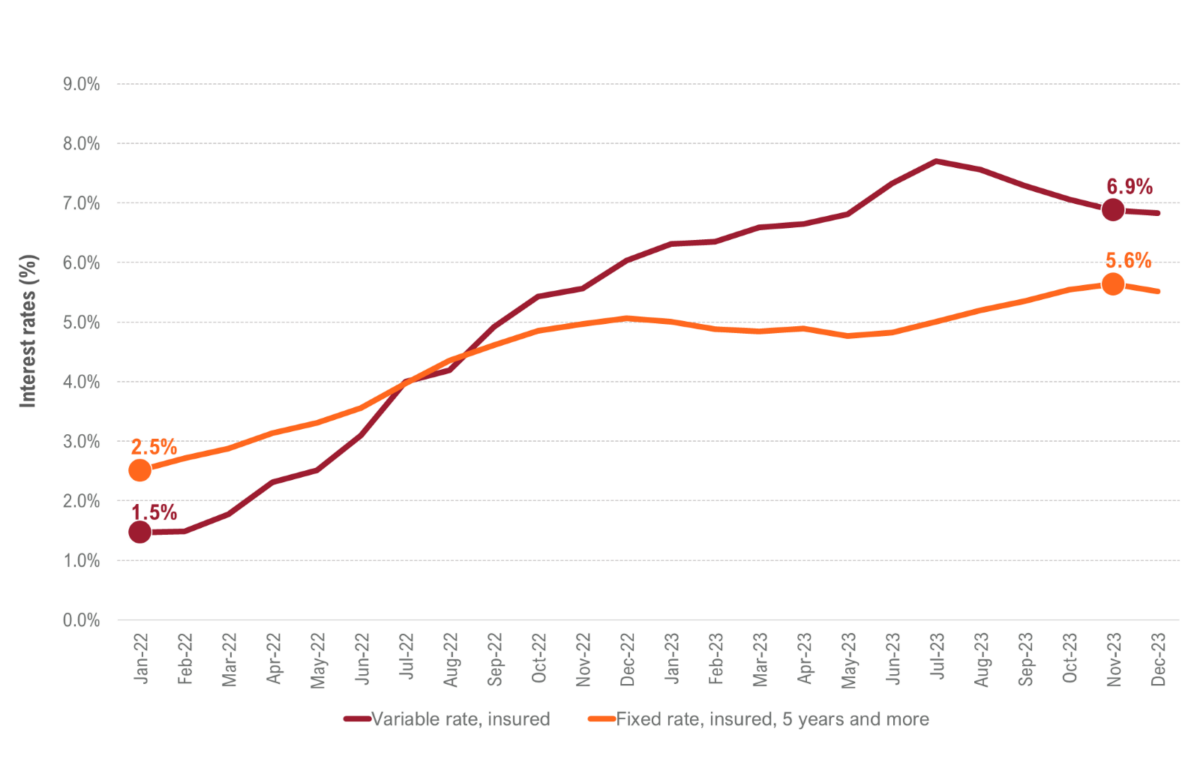

In efforts to combat inflationary pressures, the Bank of Canada began aggressively raising interest rates starting in mid-2022. These increases persisted throughout most of 2023, driving interest and mortgage lending rates higher.

Although there were expectations that interest rates would rise post-pandemic, the rate of the increase was more rapid than consumers could have anticipated. To put it into perspective, interest rates on an insured five-year (or longer) fixed mortgage increased from about 2.5% in January 2022 to a near-term high of 5.6% in November 2023. The rapid rise in interest rates were evident for all types of mortgages (new, renewing, fixed-term, and variable) and impacted the ability of households to qualify and purchase new homes in 2023.

Interest rates for residential mortgages, Canada, monthly

Fixed and variable residential mortgage rates

As qualifying for these higher-rate mortgages became more difficult, Canada’s real estate market cooled and demand for new-home construction dropped.

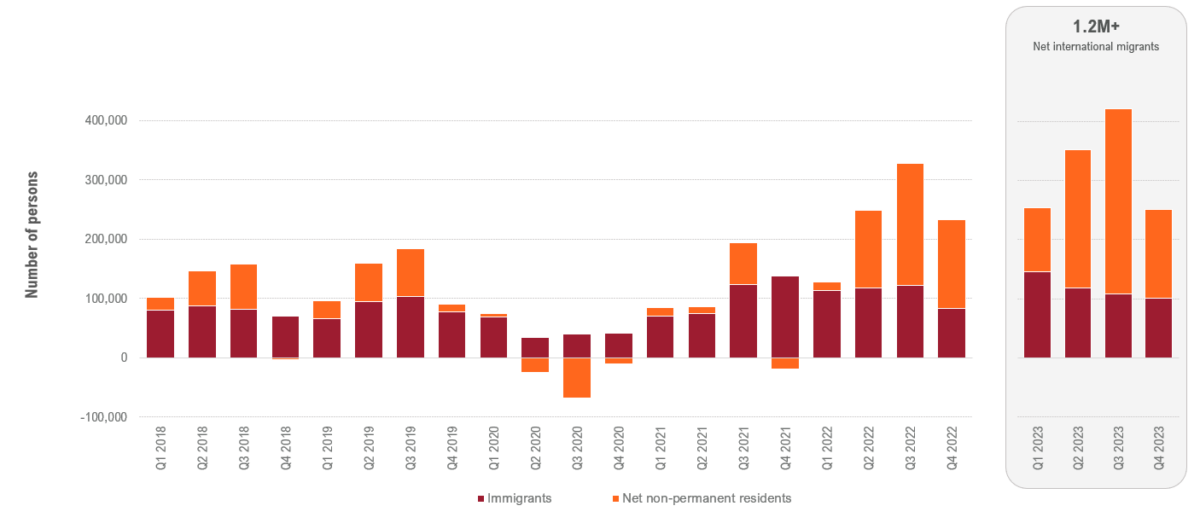

Partially offsetting this negative trend, however, was Canada’s strong population growth which continued to surge with further increases to net international migration. Throughout the year, Canada welcomed nearly 471,800 permanent residents and just over 804,900 non-permanent residents – many of whom were international students. Combined, these international migrants amounted to close to 1.3 million people joining Canada’s population last year. That figure marked an increase of 36% above 2022’s already-elevated figure of 937,900.

Not surprisingly, these high levels of international immigration were a key source of population growth for Canada, which was estimated by BuildForce Canada at 3% for the year – the highest growth rate recorded in the past decade.

Components of international migration, Canada, quarterly

Number of permanent and non-permanent immigrants

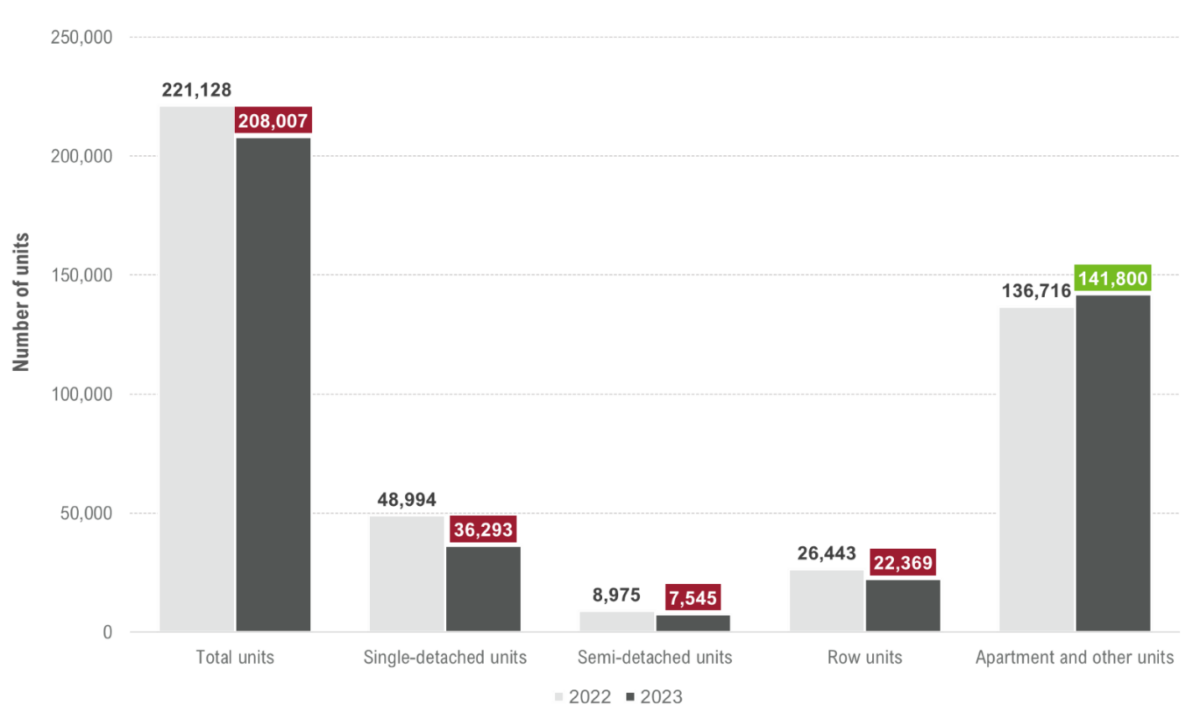

These strong levels of international migration into the country added to demands for new housing, offsetting some of the negative forces created from rising interest rates. Nevertheless, new-home construction was down almost every month and in nearly every province in 2023, reflecting the impact of rapidly rising interest rates. By the end of December, over 208,000 new residential units had been started in Canada, reflecting a 6% decline from the same period in 2022.

Rising interest rates impacted the construction of low-rise units disproportionately, as these tend to be relatively more expensive than mid- and high-rise units.

Single-detached housing starts saw the sharpest reductions, down by 26% across the country overall, and down by as much as 42% in Quebec, 39% in Newfoundland and Labrador, and 33% in Ontario. Construction of these relatively more expensive units was reduced in every province across the country.

The arrival of greater numbers of international migrants, who tend to rent before buying, and rising costs due to higher interest rates dictated a shift towards more affordable units. The construction of apartment buildings increased by 4% for Canada (all-provinces), with six provinces, including Ontario and British Columbia, reporting increased apartment-type unit housing starts.

In some Atlantic and Prairie provinces, the shift was toward semi-detached and row housing units. Nova Scotia (+82%) and Saskatchewan (+31%), in particular, saw strong increases in semi-detached housing starts over 2022 levels.

Housing starts by structure type 2023 versus 2022, Canada

These trends are also supported by building permit data. The number and value of single dwelling building permits were down across all provinces and across most major metropolitan areas. These trends were prevalent for both renovations and new-home construction, although declines in renovations were more modest.

For multiple dwelling buildings, there was only a modest decline in the value and number of building permits. Some provinces experienced growth while others saw declines. Moreover, most of the decline was related to new-home construction although some provinces also saw the value and number of building permits related to renovations contract.

Interest rate pressures are expected to persist into 2024 before easing into 2025 and beyond. Our 2024 to 2033 Construction and Maintenance Looking Forward highlight reports provide more detail into these expected trends.

In part three of this series, scheduled for release in July, we look at the trends that influenced growth in the non-residential sector last year.

Construction Key Indicators